Last week in Medical Bills, we reviewed the components of a medical bill and how to read it. Today, we are going to do the same type of review on an insurance explanation of benefits

What is an insurance Explanation of Benefits(EOB)?:

In this paragraph, I’m talking about what an insurance EOB contains. An explanation of benefits is a statement from your insurance illustrating how your benefits are applied to a recent medical service. For example, you visited the doctor for an exam. After your visit, the doctors’ office creates a bill (called a “claim”) and submits it to your insurance. Your insurance processes the claim according to your benefit plan. After the claim process, the insurance company makes payment to the doctor. The insurance company also sends you a copy of the explanation of benefits showing exactly how they processed the claim.

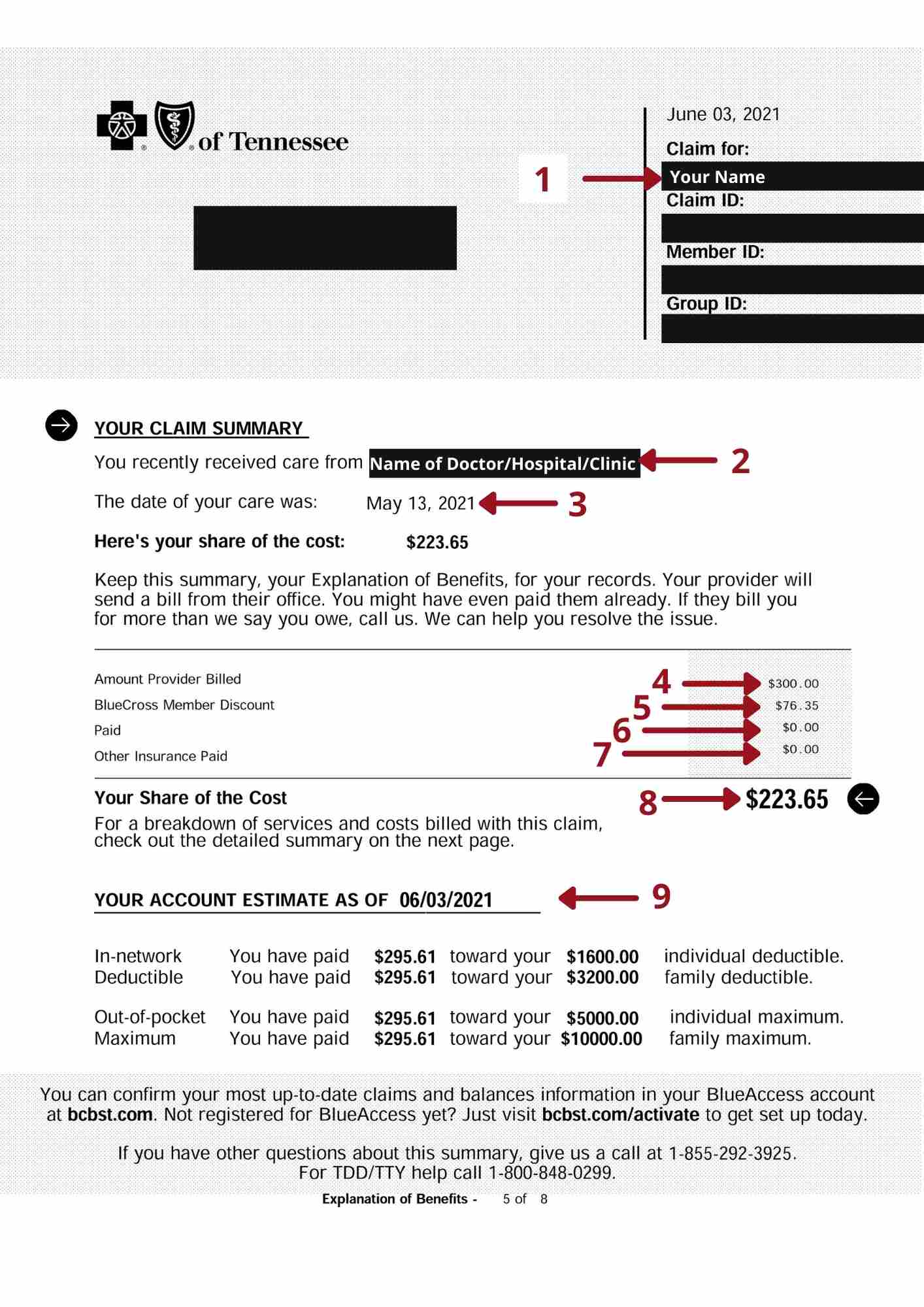

Example of an EOB:

Because Explanations of Benefits is just as confusing as medical bills, I included an example. For instance, below is a typical explanation of benefits containing detailed descriptions of each component. Remember, this is NOT the bill. This is only the statement of how the claim was processed according to your benefit plan.

Explanation of Benefits Page 1

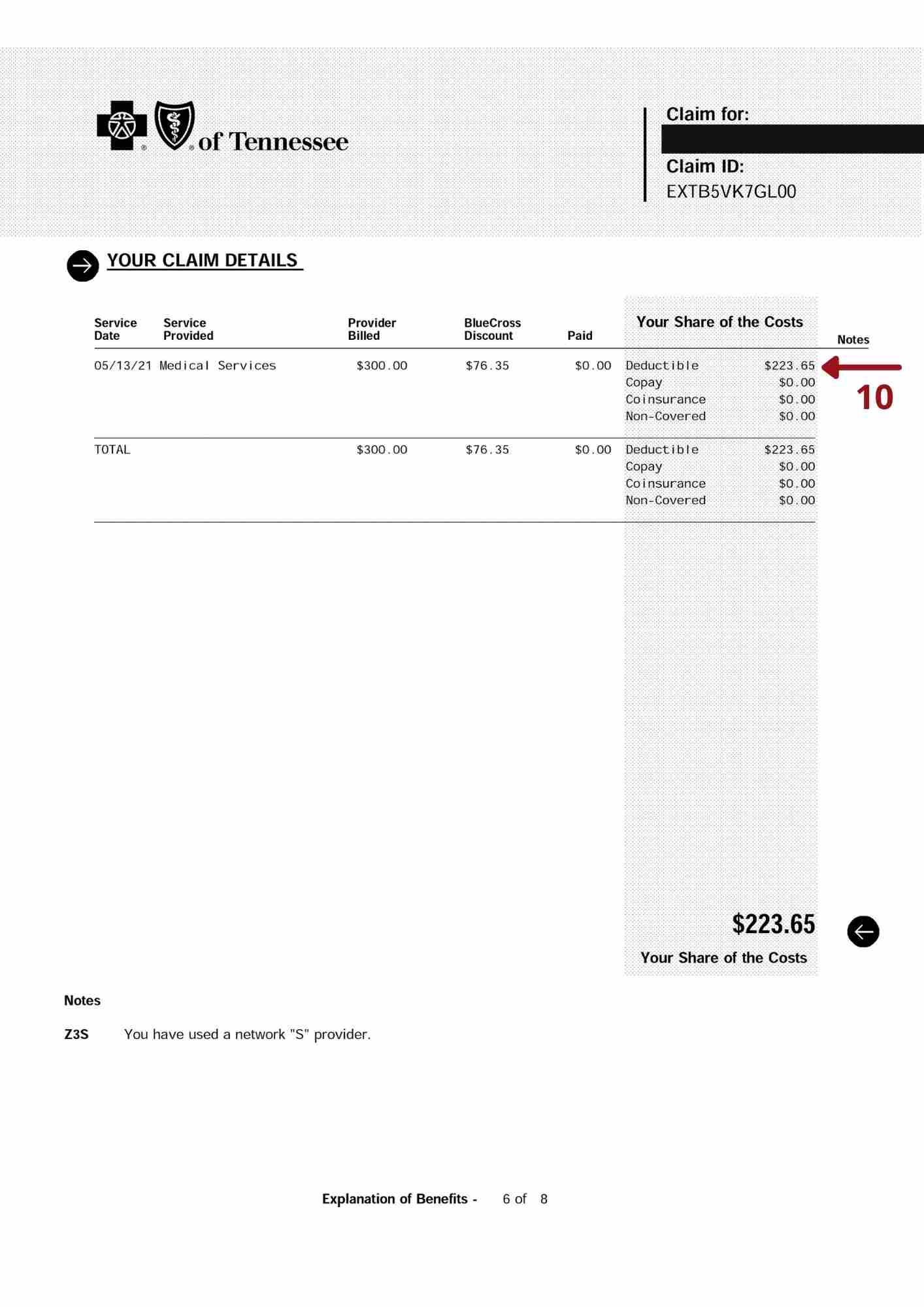

Explanation of Benefits Page 2

Components of an Explanation of Benefits:

In the above example, the standard items are listed below:

-

Member name – the name of the patient receiving services

-

Provider – name of person/facility providing services

-

Date of Service – date patient received services

-

Amount Billed – total amount billed to insurance

-

Member Discount – discount negotiated by insurance

-

Paid – the amount paid to the provider of services by insurance

-

Other Insurance Paid – the amount paid to the provider of services by another insurance (if you have other insurance)

-

Your Share of the Cost – the amount due from you/patient

-

Account Estimates – amount of deductible and out of pocket expenses you have met as of the date shown

-

Your Share of the Cost – explained (in this case, I pay $223.65 towards my deductible)

Item of Interest:

Because I have not met my deductible, my insurance does not pay anything toward this claim. I do receive the negotiated discount, but am responsible for the remaining balance due to my doctor.

Conclusion:

In conclusion, knowing how to read your explanation of benefits is the second step to only paying what you owe. If you missed the first step, check out Medical Bills: Learn How to Read Yours. Next week, we will use these two examples to cross-check and ensure they are accurate.

Don’t forget to pick up the Medical Bill Checklist I use to review my own medical bills!

If you find yourself needing more assistance, please reach out to me directly at [email protected]